Table Of Content

- Places with the highest median down payments (in dollars)

- The average down payment for a home in early June 2021 was $27,850

- What happens if I can't afford the minimum down payment required?

- How does your credit score impact your down payment?

- Jumbo loan: 10 percent down payment

- Our top picks of timely offers from our partners

- Mortgages

Reducing the amount you need to borrow, even by a little bit, will lower the amount you pay in interest over time, and it can lower your monthly payments as well. Coming up with a down payment can be the hardest part of buying a home—particularly for first-time buyers. Though it makes financial sense to go with a down payment of at least 20%, it’s not always possible to save that much once you realize you’re ready to buy a house and need a place to live. If you can't afford the down payment on a home you want, you may want to continue saving until you build up your savings enough to qualify.

Places with the highest median down payments (in dollars)

The average down payment in America is approximately percent of the loan value for a typical borrower. However, depending on your loan type and credit score, you may be able to purchase a home with as little as 3% down. How has this housing market affected the average down payment on a home? The Ascent, a Motley Fool service, dug into the data to find out.

The average down payment for a home in early June 2021 was $27,850

As home prices have risen, so has the percentage of home buyers that make at least a 20% down payment or an all-cash purchase. This could be a function of a more competitive housing market -- a 20% down payment makes it easier to obtain financing while all-cash purchases greatly increase your chances of sealing a deal. A down payment of at least 20% of your home’s value is usually necessary to avoid paying for private mortgage insurance (PMI).

What happens if I can't afford the minimum down payment required?

The average down payment varies a great deal depending on the age of the buyer, as well. The average down payment for a home varies quite a bit depending on the state you live in, which makes sense when you consider how widely housing prices vary nationwide. FHA loans typically require a minimum down payment of 3.5%, although you may need a down payment of at least 10% if your credit score is between 500 and 579. These loans come with competitive rates and terms, yet they are only available for the purchase of a home you plan to live in. In recent years, the eligibility conditions for a conventional loan have become heavily reliant on your credit score and financial situation.

How does your credit score impact your down payment?

You could also consider a rent-to-own arrangement, where you rent a home with the option to buy it later. During the rental period, a portion of your payments will cover the rent while the rest will be put toward a down payment on the house. This can help you avoid having to come up with a large lump sum to put down—though keep in mind that it’s best to get preapproved for a mortgage beforehand to make sure the home is in your budget. Sometimes you will still need to fund part of the down payment yourself, but you might only need to come up with 1% or 2% of the purchase price instead of 3% or more. If you got a mortgage for 100% of the purchase price, your down payment would be 0%.

Jumbo loan: 10 percent down payment

What is the Median Down Payment in America, by State? - Visual Capitalist

What is the Median Down Payment in America, by State?.

Posted: Mon, 26 Feb 2024 08:00:00 GMT [source]

The myth of the 20% down payment comes from the PMI requirement. PMI is a type of mortgage insurance that conventional loan lenders often require for their own protection in the unfortunate event that a borrower ends up defaulting on their home loan. Most lenders require that you pay for PMI if you bring a down payment of less than 20% to the closing table. Aspiring buyers typically ask, “Is it best to put 20% down on a house?

Average Down Payment On A House - Bankrate.com

Average Down Payment On A House.

Posted: Thu, 29 Feb 2024 08:00:00 GMT [source]

Just as home prices vary widely across the U.S., down payment amounts vary by location. The higher down payments tend to be concentrated in higher-cost states like California, Hawaii, Massachusetts and Washington. There are many home buyer assistance programs available through state and local governments.

Mortgages

The company explains that most first-time buyers nowadays are paying less than 10% down on a home, as compared to the 19% average down payment by repeat buyers. In order to comfortably afford a median-priced home, a first-time buyer paying 10% down with a mortgage rate of 7.2% (the current 30-year mortgage rate) needs to earn an income of $119,769 annually. In fact, many people do put down less than 20% when buying a home. The median down payment for all US homebuyers in 2023 was 14% of the purchase price, according to The National Association of Realtors.

1 Client will be required to pay a 1% down payment, with the ability to pay a maximum of 3%, and Rocket Mortgage will cover an additional 2% of the client’s purchase price as a down payment, or $2,000. Offer valid on primary residence, conventional loan products only. Cost of mortgage insurance premium passed through to client effective January 2, 2024.

The GOP’s presumptive presidential nominee, Donald Trump, is seeking to make the border an election issue. Overtime protections have been a critical part of the FLSA since 1938 and were established to protect workers from exploitation and to benefit workers, their families and our communities. Strong overtime protections help build America’s middle class and ensure that workers are not overworked and underpaid. Mortgage rates did ease earlier this year, but have rebounded as stubborn inflation has spurred the Fed to push back rate cuts.

Furthermore, there are income requirements that members of your household must achieve in order to qualify for a mortgage down payment reduction. If you want to avoid mortgage insurance by putting 20% down, your down payment should be $100,000. If you plan to put 8% down (the median for first-time homebuyers) it would be $40,000.

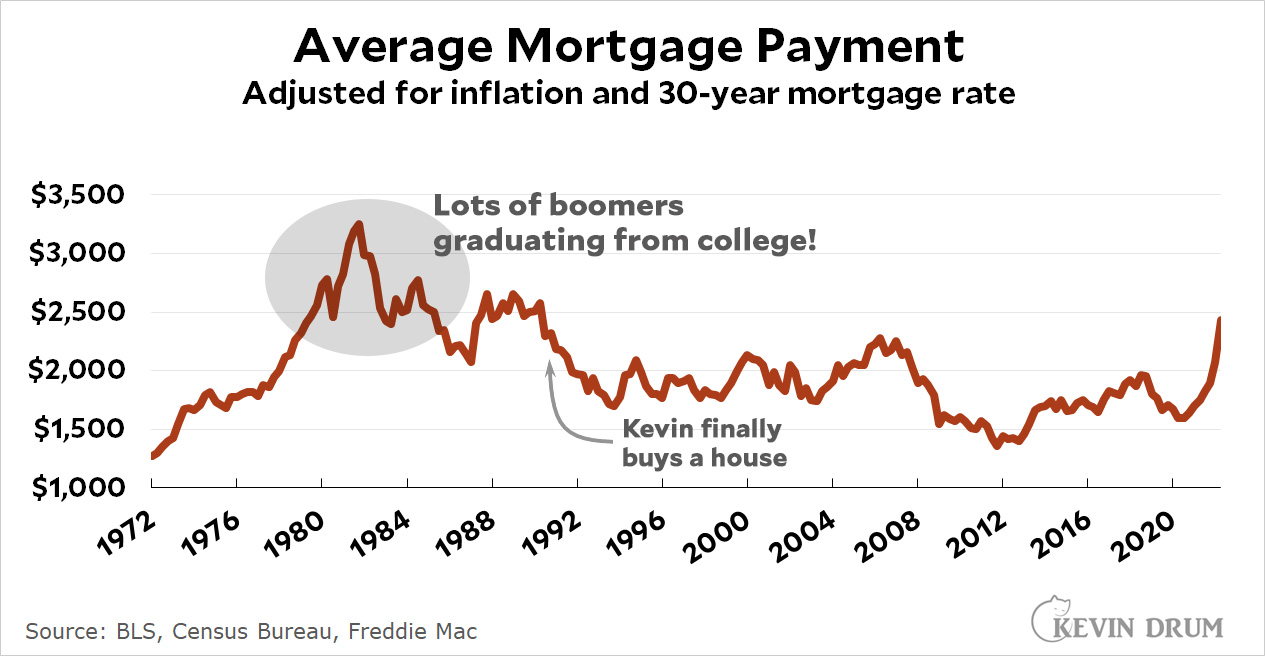

The table above reflects average rent prices in Downtown Los Angeles, Los Angeles, CA, broken down by the number of bedrooms, neighborhoods, and property types. The availability of data for each category is dependent on market inventory and will adjust depending on your selected filters. The average homeowner is now forking out a record $2,800 just to cover their monthly payment, as soaring house prices and surging interest rates have made it costlier than ever to own a home. The table above reflects average rent prices in Los Angeles, CA, broken down by the number of bedrooms, neighborhoods, and property types.

This is probably why a lot of buyers think they need to pay 20% down. This means they can use equity — rather than depending on their savings account — to make their down payment. They’re also less likely to have obligations like student loan debt and car payments. As noted earlier, the typical down payment for first-time home buyers in America is about 6% of the purchase price.

Department of Agriculture (USDA) guarantee zero-down payment loans for qualified homebuyers. If you put down 10 percent or more, this annual MIP can be removed after 11 years. With a smaller down payment, you’ll pay this expense for the life of the loan. Sometimes it’s a low-interest loan or a no-interest loan that you’ll have to pay back. Down payment assistance also can be a forgivable loan that you won’t have to repay as long as you live in the home for a certain amount of time. Other than what you can afford, the biggest factor affecting your down payment is the type of mortgage you want to qualify for.

Most of these programs are designed for first-time home buying, but repeat buyers can often qualify when they haven’t owned a home for the past three years. Department of Agriculture, USDA loans require borrowers to have modest income and to buy a home in a designated area. USDA-eligible areas are generally rural but include some less-populated suburbs. But 20% should earn you a lower interest rate than someone with a smaller down payment and the same credit score and debt-to-income ratio.

The upshot is that anyone taking out a mortgage to buy a home is paying a lot more every month than in the past. As of April 2024, the median rent for all bedroom counts and property types in Los Angeles, CA is $2,720. But even with a 20% down payment, which would lower the monthly cost, the average American is still unable to afford a home in most places. Median earners — those making $74,755 — paying down 20% of a home's value can only comfortably buy homes in four U.S. states and six of the 50 largest cities. Interest rates are now presumably at their peak, but Fed officials have remained unclear on the timing of their first cut.

No comments:

Post a Comment